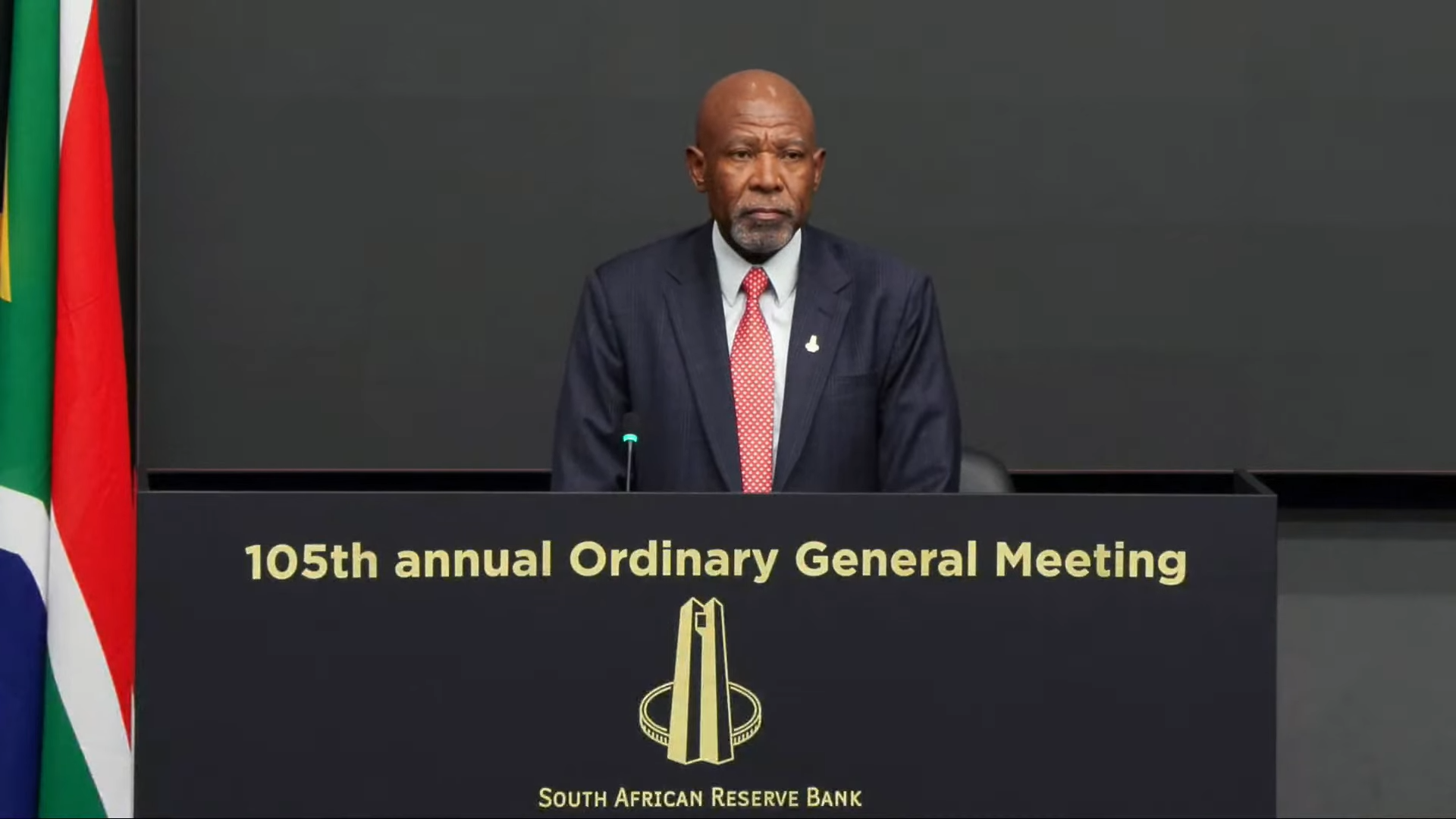

Image Credit: SAReserveBank

Pretoria – 8 August 2025

The South African Reserve Bank (SARB) has moved to calm concerns over newly imposed 30% US tariffs on South African imports, saying the economic fallout will be limited and unlikely to trigger major inflationary pressures.

Speaking at the central bank’s Annual General Meeting in Pretoria on Friday, SARB Governor Lesetja Kganyago said preliminary assessments showed only a marginal hit to economic growth and virtually no effect on inflation.

“Our preliminary assessment is that tariffs and the other uncertainties in the global economy are causing modest damage to growth while leaving inflation broadly unchanged,” Kganyago told shareholders.

US Tariffs and Trade Context

The tariffs – the highest rate imposed on any Sub-Saharan African nation came into effect after South Africa failed to finalise a trade agreement with Washington ahead of US President Donald Trump’s deadline.

The United States is a significant trading partner, accounting for 7% of South Africa’s exports as of June 2025. However, Kganyago noted that this share is smaller than China’s 12% and Germany’s 8%, and far below the combined volume of trade with the Southern African Development Community (SADC).

According to SARS data, the export mix to the US includes precious metals, vehicles, agricultural products, and industrial machinery sectors that may now face reduced competitiveness in the American market.

Economic Impact Projections

The SARB’s updated economic models show that the new tariffs have lowered its 2025 GDP growth forecast by only 0.1 percentage points, keeping growth expectations around 1% for the year.

“This is a setback, but not catastrophic,” Kganyago stressed, linking sluggish growth more to a decade-long stagnation trend than to any single trade policy change.

Industry associations had earlier warned of potential job losses in manufacturing, agriculture, and mining. President Cyril Ramaphosa has since held direct talks with President Trump to accelerate trade negotiations and ease tariff pressures.

Investor Confidence and Market Resilience

Despite the tariff shock, South African financial markets remained stable this week, reflecting investor confidence in the country’s ability to adapt.

In a note to clients, ETM Analytics said:

“Investors believe South African businesses will find ways to mitigate the impact and pivot to alternative markets, reducing reliance on the US for exports.”

Several trade analysts suggest that sectors affected by US duties could redirect exports to Europe, Asia, and intra-African markets under the African Continental Free Trade Area (AfCFTA).

While the US tariffs present a short-term challenge, the SARB’s stance suggests no immediate threat to macroeconomic stability. The greater concern, according to Kganyago, remains structural economic stagnation, which requires domestic reforms, infrastructure investment, and market diversification to unlock sustainable growth.

Key Points:

- US tariffs on SA imports: 30%, highest in Sub-Saharan Africa.

- Share of exports to US: 7% (vs China’s 12% and Germany’s 8%).

- Impact on growth: Down by only 0.1 percentage points in 2025.

- SARB inflation outlook: Broadly unchanged.

- Markets: Resilient, with investor confidence in trade adaptability.